AmCham - Bain Barometer | Prez | En

Satisfaction of American investors in France

AMCHAM–BAIN BAROMETER 2017 Satisfaction of American investors in France rd November 23 2017

ABOUT THE AMCHAM-BAIN BAROMETER th Today in its 18 edition, the AmCham-Bain Barometer has 3 objectives • Measure from year to year the morale of American investors in France and their perception of the economic environment The Barometer has • Collect the opinions of American become an annual event investors on current economic since 1999 with the topics in France The satisfaction survey of support of Bain & American investors in • Understand American employees’ Company drivers and detractors of living in France was launched by France AmCham in 1995 2

METHODOLOGY In October 2017, a questionnaire was sent to the management of subsidiaries of American companies in France We received 156 answers from US companies representing in total: •More than 70,000 employees in France •More than €53 billion turnover in France 3

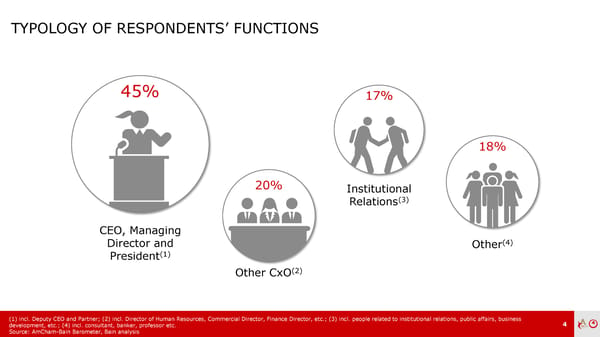

TYPOLOGY OF RESPONDENTS’ FUNCTIONS 45% 17% 18% 20% Institutional Relations(3) CEO, Managing Director and (4) Other (1) President Other CxO(2) (1) incl. Deputy CEO and Partner; (2) incl. Director of Human Resources, Commercial Director, Finance Director, etc.; (3) incl. people related to institutional relations, public affairs, business development, etc.; (4) incl. consultant, banker, professor etc. 4 Source: AmCham-Bain Barometer, Bain analysis

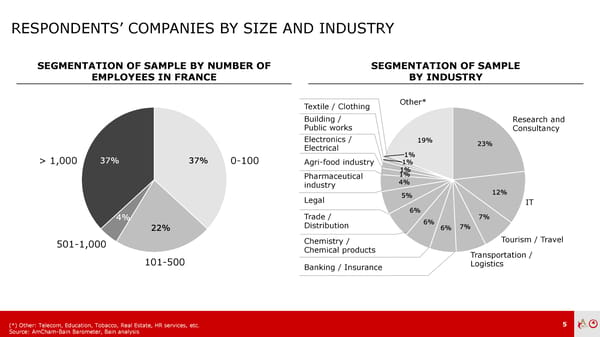

RESPONDENTS’ COMPANIES BY SIZE AND INDUSTRY SEGMENTATION OF SAMPLE BY NUMBER OF SEGMENTATION OF SAMPLE EMPLOYEES IN FRANCE BY INDUSTRY Textile / Clothing Other* Building / Research and Public works Consultancy Electronics / Electrical > 1,000 0-100 Agri-food industry Pharmaceutical industry Legal IT Trade / Distribution 501-1,000 Chemistry / Tourism / Travel Chemical products Transportation / 101-500 Banking / Insurance Logistics (*) Other: Telecom, Education, Tobacco, Real Estate, HR services, etc. 5 Source: AmCham-Bain Barometer, Bain analysis

AGENDA FRANCE’S ATTRACTIVENESS DIGITAL TRANSFORMATION OF COMPANIES IN FRANCE MAJOR EVENTS IMPACTING FRANCE’S ATTRACTIVENESS AMCHAM RECOMMENDATIONS 6

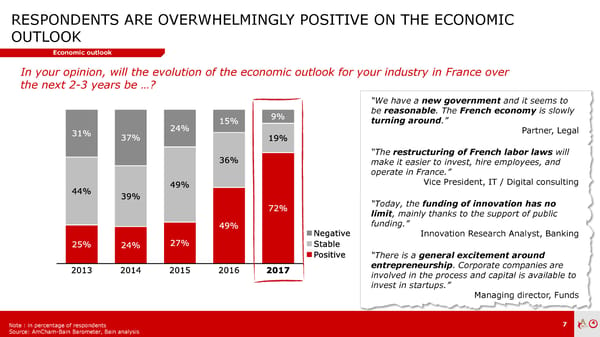

RESPONDENTS ARE OVERWHELMINGLY POSITIVE ON THE ECONOMIC OUTLOOK Economic outlook In your opinion, will the evolution of the economic outlook for your industry in France over the next 2-3 years be …? “We have a new government and it seems to be reasonable. The French economy is slowly turning around.” Partner, Legal “The restructuring of French labor laws will make it easier to invest, hire employees, and operate in France.” Vice President, IT / Digital consulting “Today, the funding of innovation has no limit, mainly thanks to the support of public funding.” Innovation Research Analyst, Banking “There is a general excitement around entrepreneurship. Corporate companies are involved in the process and capital is available to invest in startups.” Managing director, Funds Note : in percentage of respondents 7 Source: AmCham-Bain Barometer, Bain analysis

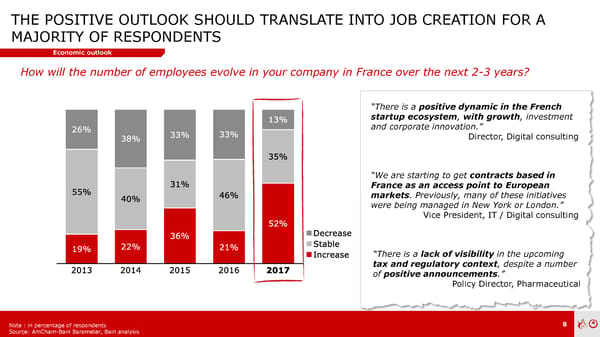

THE POSITIVE OUTLOOK SHOULD TRANSLATE INTO JOB CREATION FOR A MAJORITY OF RESPONDENTS Economic outlook How will the number of employees evolve in your company in France over the next 2-3 years? “There is a positive dynamic in the French startup ecosystem, with growth, investment and corporate innovation.” Director, Digital consulting “We are starting to get contracts based in France as an access point to European markets. Previously, many of these initiatives were being managed in New York or London.” Vice President, IT / Digital consulting “There is a lack of visibility in the upcoming tax and regulatory context, despite a number of positive announcements.” Policy Director, Pharmaceutical Note : in percentage of respondents 8 Source: AmCham-Bain Barometer, Bain analysis

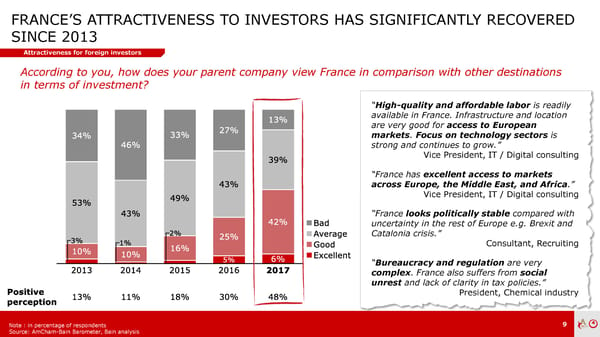

FRANCE’S ATTRACTIVENESS TO INVESTORS HAS SIGNIFICANTLY RECOVERED SINCE 2013 Attractiveness for foreign investors According to you, how does your parent company view France in comparison with other destinations in terms of investment? “High-quality and affordable labor is readily available in France. Infrastructure and location are very good for access to European markets. Focus on technology sectors is strong and continues to grow.” Vice President, IT / Digital consulting “France has excellent access to markets across Europe, the Middle East, and Africa.” Vice President, IT / Digital consulting “France looks politically stable compared with uncertainty in the rest of Europe e.g. Brexit and Catalonia crisis.” Consultant, Recruiting “Bureaucracy and regulation are very complex. France also suffers from social unrest and lack of clarity in tax policies.” President, Chemical industry Note : in percentage of respondents 9 Source: AmCham-Bain Barometer, Bain analysis

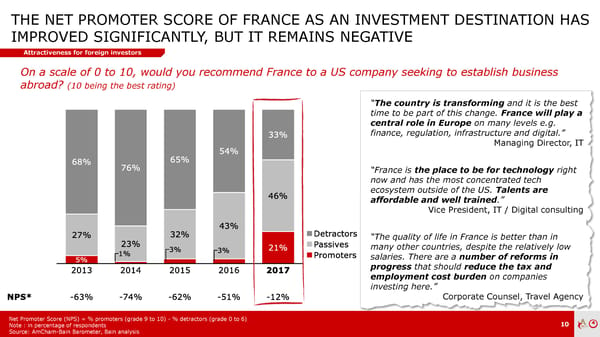

THE NET PROMOTER SCORE OF FRANCE AS AN INVESTMENT DESTINATION HAS IMPROVED SIGNIFICANTLY, BUT IT REMAINS NEGATIVE Attractiveness for foreign investors On a scale of 0 to 10, would you recommend France to a US company seeking to establish business abroad? (10 being the best rating) “The country is transforming and it is the best time to be part of this change. France will play a central role in Europe on many levels e.g. finance, regulation, infrastructure and digital.” Managing Director, IT “France is the place to be for technology right now and has the most concentrated tech ecosystem outside of the US. Talents are affordable and well trained.” Vice President, IT / Digital consulting “The quality of life in France is better than in many other countries, despite the relatively low salaries. There are a number of reforms in progress that should reduce the tax and employment cost burden on companies investing here.” Corporate Counsel, Travel Agency Net Promoter Score (NPS) = % promoters (grade 9 to 10) - % detractors (grade 0 to 6) Note : in percentage of respondents 10 Source: AmCham-Bain Barometer, Bain analysis

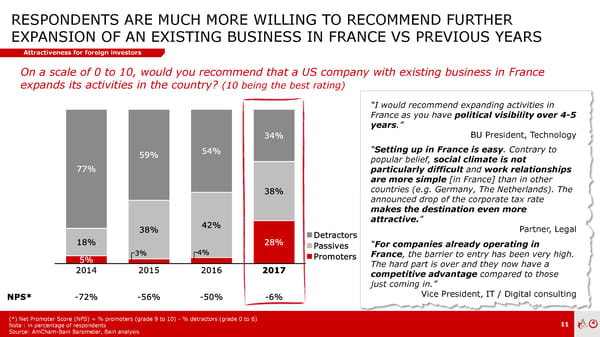

RESPONDENTS ARE MUCH MORE WILLING TO RECOMMEND FURTHER EXPANSION OF AN EXISTING BUSINESS IN FRANCE VS PREVIOUS YEARS Attractiveness for foreign investors On a scale of 0 to 10, would you recommend that a US company with existing business in France expands its activities in the country? (10 being the best rating) “I would recommend expanding activities in France as you have political visibility over 4-5 years.” BU President, Technology “Setting up in France is easy. Contrary to popular belief, social climate is not particularly difficult and work relationships are more simple [in France] than in other countries (e.g. Germany, The Netherlands). The announced drop of the corporate tax rate makes the destination even more attractive.” Partner, Legal “For companies already operating in France, the barrier to entry has been very high. The hard part is over and they now have a competitive advantage compared to those just coming in.” Vice President, IT / Digital consulting (*) Net Promoter Score (NPS) = % promoters (grade 9 to 10) - % detractors (grade 0 to 6) Note : in percentage of respondents 11 Source: AmCham-Bain Barometer, Bain analysis

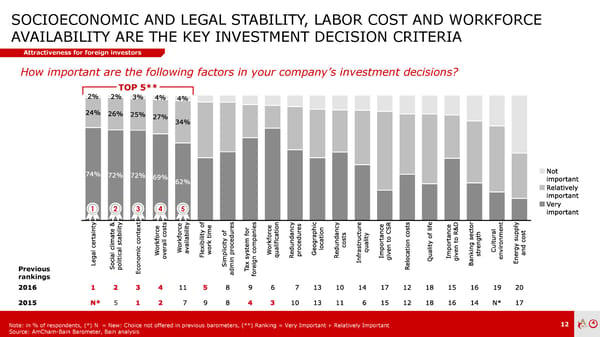

SOCIOECONOMIC AND LEGAL STABILITY, LABOR COST AND WORKFORCE AVAILABILITY ARE THE KEY INVESTMENT DECISION CRITERIA Attractiveness for foreign investors How important are the following factors in your company’s investment decisions? TOP 5** 1 2 3 4 5 Previous rankings Note: in % of respondents, (*) N = New: Choice not offered in previous barometers, (**) Ranking = Very Important + Relatively Important 12 Source: AmCham-Bain Barometer, Bain analysis

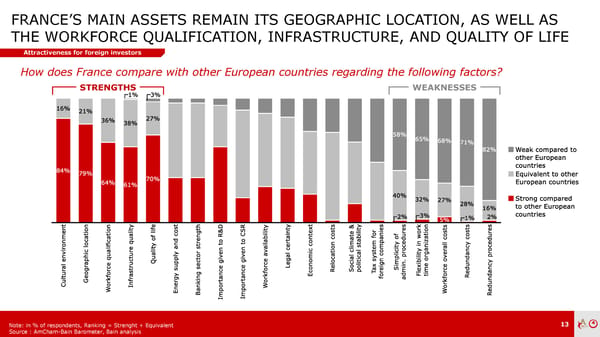

FRANCE’S MAIN ASSETS REMAIN ITS GEOGRAPHIC LOCATION, AS WELL AS THE WORKFORCE QUALIFICATION, INFRASTRUCTURE, AND QUALITY OF LIFE Attractiveness for foreign investors How does France compare with other European countries regarding the following factors? STRENGTHS WEAKNESSES Note: in % of respondents, Ranking = Strenght + Equivalent 13 Source : AmCham-Bain Barometer, Bain analysis

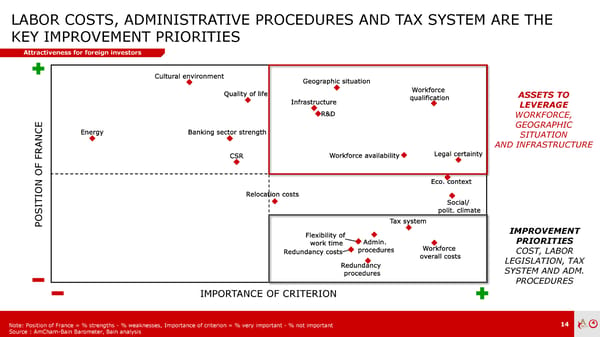

LABOR COSTS, ADMINISTRATIVE PROCEDURES AND TAX SYSTEM ARE THE KEY IMPROVEMENT PRIORITIES Attractiveness for foreign investors ASSETS TO LEVERAGE WORKFORCE, CE GEOGRAPHIC SITUATION ANFR AND INFRASTRUCTURE OF ON TI POSI IMPROVEMENT PRIORITIES COST, LABOR LEGISLATION, TAX SYSTEM AND ADM. PROCEDURES IMPORTANCE OF CRITERION Note: Position of France = % strengths - % weaknesses, Importance of criterion = % very important - % not important 14 Source : AmCham-Bain Barometer, Bain analysis

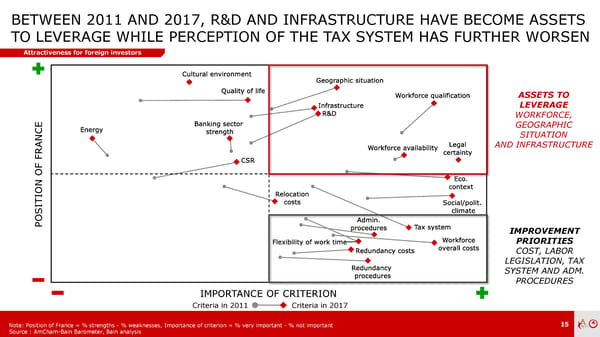

BETWEEN 2011 AND 2017, R&D AND INFRASTRUCTURE HAVE BECOME ASSETS TO LEVERAGE WHILE PERCEPTION OF THE TAX SYSTEM HAS FURTHER WORSEN Attractiveness for foreign investors ASSETS TO LEVERAGE WORKFORCE, CE GEOGRAPHIC SITUATION ANFR AND INFRASTRUCTURE OF ON TI POSI IMPROVEMENT PRIORITIES COST, LABOR LEGISLATION, TAX SYSTEM AND ADM. PROCEDURES IMPORTANCE OF CRITERION Criteria in 2011 Criteria in 2017 Note: Position of France = % strengths - % weaknesses, Importance of criterion = % very important - % not important 15 Source : AmCham-Bain Barometer, Bain analysis

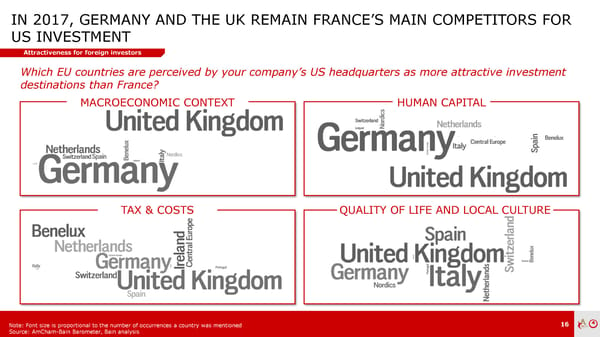

IN 2017, GERMANY AND THE UK REMAIN FRANCE’S MAIN COMPETITORS FOR US INVESTMENT Attractiveness for foreign investors Which EU countries are perceived by your company’s US headquarters as more attractive investment destinations than France? MACROECONOMIC CONTEXT HUMAN CAPITAL TAX & COSTS QUALITY OF LIFE AND LOCAL CULTURE Note: Font size is proportional to the number of occurrences a country was mentioned 16 Source: AmCham-Bain Barometer, Bain analysis

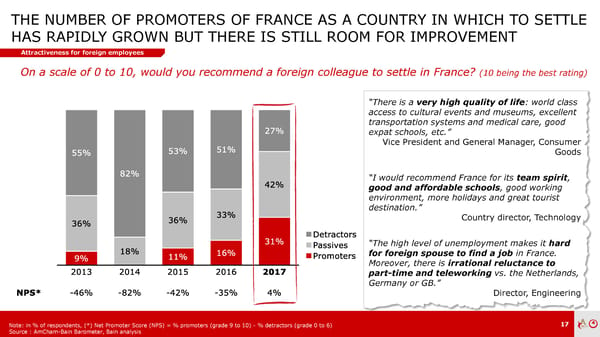

THE NUMBER OF PROMOTERS OF FRANCE AS A COUNTRY IN WHICH TO SETTLE HAS RAPIDLY GROWN BUT THERE IS STILL ROOM FOR IMPROVEMENT Attractiveness for foreign employees On a scale of 0 to 10, would you recommend a foreign colleague to settle in France? (10 being the best rating) “There is a very high quality of life: world class access to cultural events and museums, excellent transportation systems and medical care, good expat schools, etc.” Vice President and General Manager, Consumer Goods “I would recommend France for its team spirit, good and affordable schools, good working environment, more holidays and great tourist destination.” Country director, Technology “The high level of unemployment makes it hard for foreign spouse to find a job in France. Moreover, there is irrational reluctance to part-time and teleworking vs. the Netherlands, Germany or GB.” Director, Engineering Note: in % of respondents, (*) Net Promoter Score (NPS) = % promoters (grade 9 to 10) - % detractors (grade 0 to 6) 17 Source : AmCham-Bain Barometer, Bain analysis

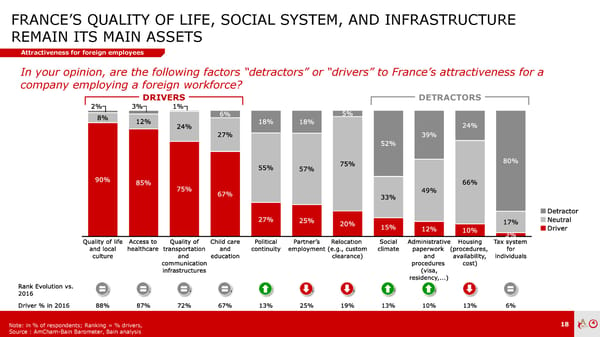

FRANCE’S QUALITY OF LIFE, SOCIAL SYSTEM, AND INFRASTRUCTURE REMAIN ITS MAIN ASSETS Attractiveness for foreign employees In your opinion, are the following factors “detractors” or “drivers” to France’s attractiveness for a company employing a foreign workforce? DRIVERS DETRACTORS Note: in % of respondents; Ranking = % drivers, 18 Source : AmCham-Bain Barometer, Bain analysis

FRANCE’S QUALITY OF LIFE, SOCIAL SYSTEM, AND INFRASTRUCTURE REMAIN ITS MAIN ASSETS Attractiveness for foreign employees In your opinion, are the following factors “detractors” or “drivers” to France’s attractiveness for a company employing a foreign workforce? DRIVERS DETRACTORS “International schools are a real advantage.” “High corporate taxes and inflexibility of labor Managing Director, Logistics & Supply Chain law have given a bad image of France.” Director, Pharmaceutics / Consumer Goods “France offers good talent with high scientific “France suffers from an image of social unrest, in potential as well as excellent infrastructure and particular for the number of strikes. The tax system, communication network.” including employment-related taxes and social Director, Pharmaceutics / Consumer Goods security charges, is complex and costly, which has stopped more than one company from investing here.” Corporate Counsel, Travel Agency “France offers a great healthcare system and good quality of medical care and dentistry. […] The “Administrative procedures are time-consuming country is also renowned for gastronomy and and complex. There is also poor visibility due to a wine.” lack of tax and regulatory stability.” Director, Delivery / Supply Chain Policy Director, Pharmaceutics 19 Source : AmCham-Bain Barometer, Bain analysis

AGENDA FRANCE’S ATTRACTIVENESS DIGITAL TRANSFORMATION OF COMPANIES IN FRANCE MAJOR EVENTS IMPACTING FRANCE’S ATTRACTIVENESS AMCHAM RECOMMENDATIONS 20

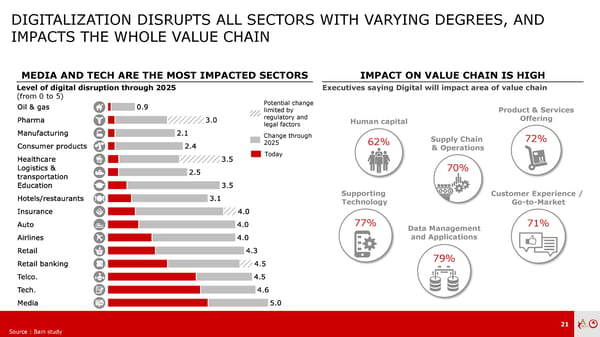

DIGITALIZATION DISRUPTS ALL SECTORS WITH VARYING DEGREES, AND IMPACTS THE WHOLE VALUE CHAIN MEDIA AND TECH ARE THE MOST IMPACTED SECTORS IMPACT ON VALUE CHAIN IS HIGH Level of digital disruption through 2025 Executives saying Digital will impact area of value chain (from 0 to 5) Potential change limited by Product & Services regulatory and Human capital Offering legal factors Change through Supply Chain 72% 2025 62% & Operations Today 70% Supporting Customer Experience / Technology Go-to-Market 77% Data Management 71% and Applications 79% 21 Source : Bain study

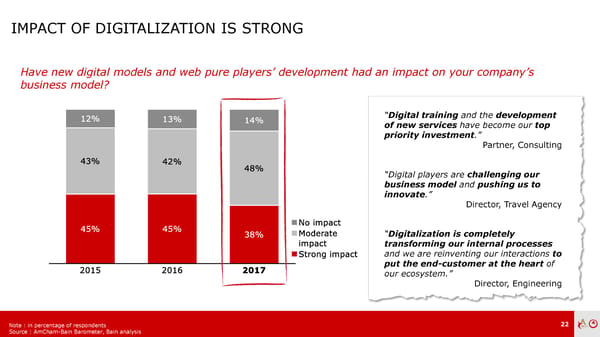

IMPACT OF DIGITALIZATION IS STRONG Have new digital models and web pure players’ development had an impact on your company’s business model? “Digital training and the development of new services have become our top priority investment.” Partner, Consulting “Digital players are challenging our business model and pushing us to innovate.” Director, Travel Agency “Digitalization is completely transforming our internal processes and we are reinventing our interactions to put the end-customer at the heart of our ecosystem.” Director, Engineering Note : in percentage of respondents 22 Source : AmCham-Bain Barometer, Bain analysis

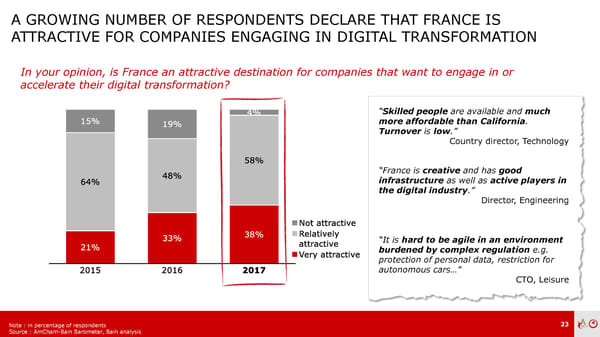

A GROWING NUMBER OF RESPONDENTS DECLARE THAT FRANCE IS ATTRACTIVE FOR COMPANIES ENGAGING IN DIGITAL TRANSFORMATION In your opinion, is France an attractive destination for companies that want to engage in or accelerate their digital transformation? “Skilled people are available and much more affordable than California. Turnover is low.” Country director, Technology “France is creative and has good infrastructure as well as active players in the digital industry.” Director, Engineering “It is hard to be agile in an environment burdened by complex regulation e.g. protection of personal data, restriction for autonomous cars…” CTO, Leisure Note : in percentage of respondents 23 Source : AmCham-Bain Barometer, Bain analysis

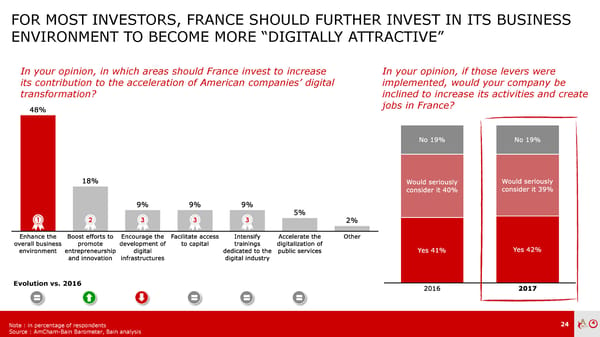

FOR MOST INVESTORS, FRANCE SHOULD FURTHER INVEST IN ITS BUSINESS ENVIRONMENT TO BECOME MORE “DIGITALLY ATTRACTIVE” In your opinion, in which areas should France invest to increase In your opinion, if those levers were its contribution to the acceleration of American companies’ digital implemented, would your company be transformation? inclined to increase its activities and create jobs in France? 1 2 3 3 3 Evolution vs. 2016 Note : in percentage of respondents 24 Source : AmCham-Bain Barometer, Bain analysis

FOR MOST INVESTORS, FRANCE SHOULD FURTHER INVEST IN ITS BUSINESS ENVIRONMENT TO BECOME MORE “DIGITALLY ATTRACTIVE” In your opinion, if those levers were implemented, would your company be inclined to develop its activities and create jobs in France? “France could be the future European hub for digital transformation.” BU President, Technology “Navigating public services and the French bureaucracy as well as difficult employment laws remain the biggest hurdles for us to hiring French employees and growing in France. Simplifying processes for businesses will make it easier to operate. There is already capital and there are resources in place to make France a focal point for the digital transformation.” Vice President, IT / Digital consulting “If administrative burdens on companies were seriously lowered and if the overall business environment was enhanced, we would be in a position to consider hiring.” Managing director, Consulting 25 Source : AmCham-Bain Barometer, Bain analysis

AGENDA FRANCE’S ATTRACTIVENESS DIGITAL TRANSFORMATION OF COMPANIES IN FRANCE MAJOR EVENTS IMPACTING FRANCE’S ATTRACTIVENESS AMCHAM RECOMMENDATIONS 26

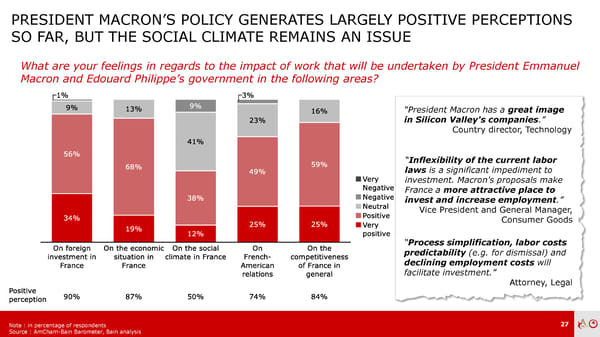

PRESIDENT MACRON’S POLICY GENERATES LARGELY POSITIVE PERCEPTIONS SO FAR, BUT THE SOCIAL CLIMATE REMAINS AN ISSUE What are your feelings in regards to the impact of work that will be undertaken by President Emmanuel Macron and Edouard Philippe’s government in the following areas? “President Macron has a great image in Silicon Valley's companies.” Country director, Technology “Inflexibility of the current labor laws is a significant impediment to investment. Macron's proposals make France a more attractive place to invest and increase employment.” Vice President and General Manager, Consumer Goods “Process simplification, labor costs predictability (e.g. for dismissal) and declining employment costs will facilitate investment.” Attorney, Legal Note : in percentage of respondents 27 Source : AmCham-Bain Barometer, Bain analysis

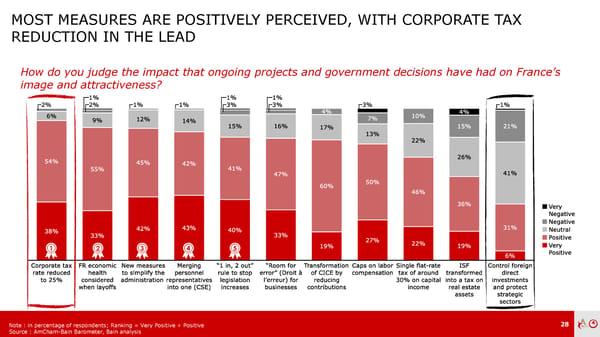

MOST MEASURES ARE POSITIVELY PERCEIVED, WITH CORPORATE TAX REDUCTION IN THE LEAD How do you judge the impact that ongoing projects and government decisions have had on France’s image and attractiveness? 1 2 3 4 5 Note : in percentage of respondents; Ranking = Very Positive + Positive 28 Source : AmCham-Bain Barometer, Bain analysis

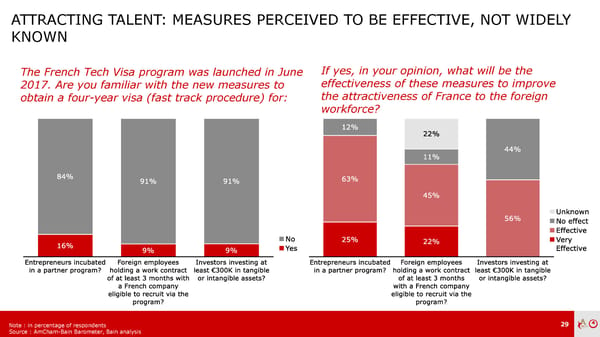

ATTRACTING TALENT: MEASURES PERCEIVED TO BE EFFECTIVE, NOT WIDELY KNOWN The French Tech Visa program was launched in June If yes, in your opinion, what will be the 2017. Are you familiar with the new measures to effectiveness of these measures to improve obtain a four-year visa (fast track procedure) for: the attractiveness of France to the foreign workforce? Note : in percentage of respondents 29 Source : AmCham-Bain Barometer, Bain analysis

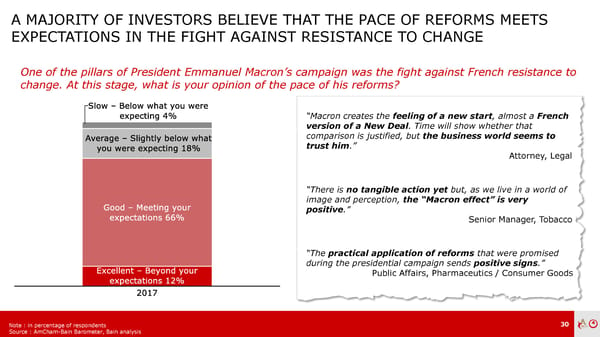

A MAJORITY OF INVESTORS BELIEVE THAT THE PACE OF REFORMS MEETS EXPECTATIONS IN THE FIGHT AGAINST RESISTANCE TO CHANGE One of the pillars of President Emmanuel Macron’s campaign was the fight against French resistance to change. At this stage, what is your opinion of the pace of his reforms? “Macron creates the feeling of a new start, almost a French version of a New Deal. Time will show whether that comparison is justified, but the business world seems to trust him.” Attorney, Legal “There is no tangible action yet but, as we live in a world of image and perception, the “Macron effect” is very positive.” Senior Manager, Tobacco “The practical application of reforms that were promised during the presidential campaign sends positive signs.” Public Affairs, Pharmaceutics / Consumer Goods Note : in percentage of respondents 30 Source : AmCham-Bain Barometer, Bain analysis

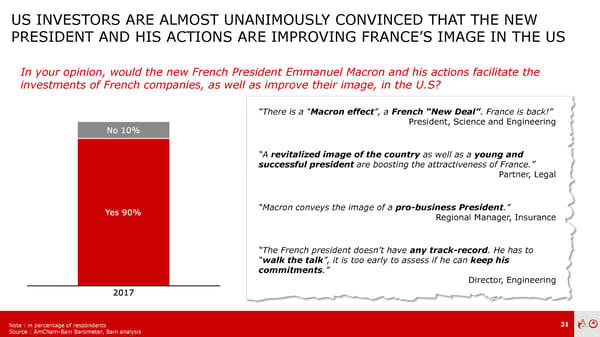

US INVESTORS ARE ALMOST UNANIMOUSLY CONVINCED THAT THE NEW PRESIDENT AND HIS ACTIONS ARE IMPROVING FRANCE’S IMAGE IN THE US In your opinion, would the new French President Emmanuel Macron and his actions facilitate the investments of French companies, as well as improve their image, in the U.S? “There is a “Macron effect”, a French “New Deal”. France is back!” President, Science and Engineering “A revitalized image of the country as well as a young and successful president are boosting the attractiveness of France.” Partner, Legal “Macron conveys the image of a pro-business President.” Regional Manager, Insurance “The French president doesn’t have any track-record. He has to “walk the talk”, it is too early to assess if he can keep his commitments.” Director, Engineering Note : in percentage of respondents 31 Source : AmCham-Bain Barometer, Bain analysis

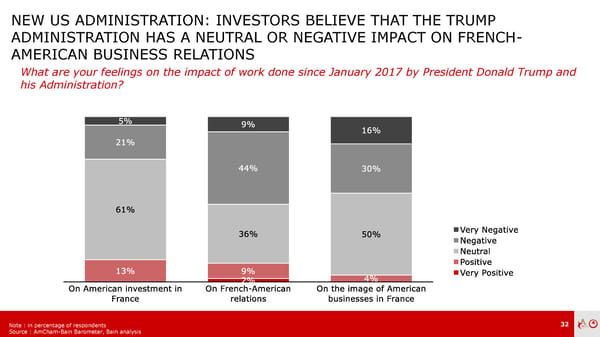

NEW US ADMINISTRATION: INVESTORS BELIEVE THAT THE TRUMP ADMINISTRATION HAS A NEUTRAL OR NEGATIVE IMPACT ON FRENCH- AMERICAN BUSINESS RELATIONS What are your feelings on the impact of work done since January 2017 by President Donald Trump and his Administration? Note : in percentage of respondents 32 Source : AmCham-Bain Barometer, Bain analysis

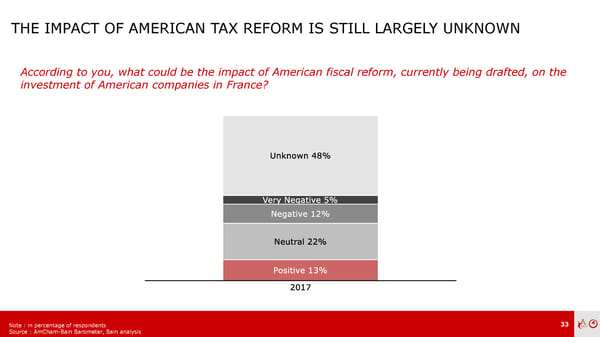

THE IMPACT OF AMERICAN TAX REFORM IS STILL LARGELY UNKNOWN According to you, what could be the impact of American fiscal reform, currently being drafted, on the investment of American companies in France? Note : in percentage of respondents 33 Source : AmCham-Bain Barometer, Bain analysis

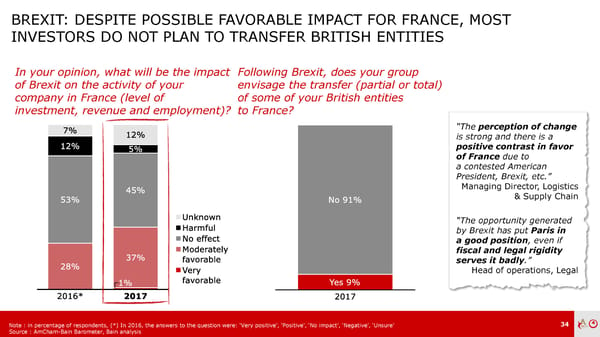

BREXIT: DESPITE POSSIBLE FAVORABLE IMPACT FOR FRANCE, MOST INVESTORS DO NOT PLAN TO TRANSFER BRITISH ENTITIES In your opinion, what will be the impact Following Brexit, does your group of Brexit on the activity of your envisage the transfer (partial or total) company in France (level of of some of your British entities investment, revenue and employment)? to France? “The perception of change is strong and there is a positive contrast in favor of France due to a contested American President, Brexit, etc.” Managing Director, Logistics & Supply Chain “The opportunity generated by Brexit has put Paris in a good position, even if fiscal and legal rigidity serves it badly.” Head of operations, Legal Note : in percentage of respondents, (*) In 2016, the answers to the question were: ‘Very positive’, ‘Positive’, ‘No impact’, ‘Negative’, ‘Unsure’ 34 Source : AmCham-Bain Barometer, Bain analysis

AGENDA FRANCE’S ATTRACTIVENESS DIGITAL TRANSFORMATION OF COMPANIES IN FRANCE MAJOR EVENTS IMPACTING FRANCE’S ATTRACTIVENESS AMCHAM RECOMMENDATIONS 35

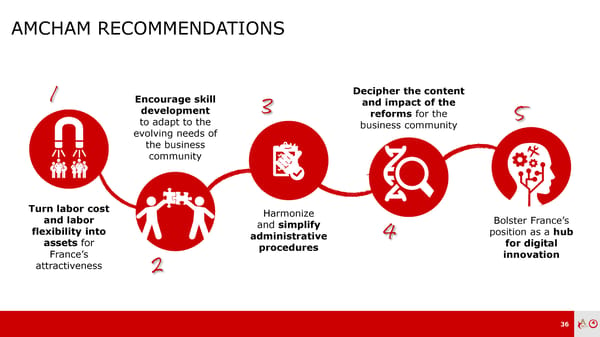

AMCHAMRECOMMENDATIONS Encourage skill Decipher the content development and impact of the to adapt to the reforms for the evolving needs of business community the business community Turn labor cost Harmonize and labor and simplify Bolster France’s flexibility into administrative position as a hub assets for procedures for digital France’s innovation attractiveness 36

CONTACTS Marc-André Kamel, Partner +33 1 44 55 75 69 Jérémie Gallon, Managing Director Study [email protected] +33 1 56 43 45 61 Study [email protected] Caroline Detalle Image 7 Giulia Buttini +33 1 44 55 75 75 +33 1 53 70 74 70 +33 1 56 43 45 62 Press [email protected] Press [email protected] Stéphanie Herrmann +33 1 44 55 77 65 [email protected] 38

BACK-UP 39

RESPONDENTS ARE OVERWHELMINGLY POSITIVE ON THE ECONOMIC OUTLOOK Economic outlook In your opinion, will the evolution of the economic outlook for your industry in France over the next 2-3 years be …? “We have a new government and it seems to be reasonable. The French economy is slowly turning around.” Partner, Legal “The restructuring of French labor laws will make it easier to invest, hire employees, and operate in France.” Vice President, IT / Digital consulting “Today, the funding of innovation has no limit, mainly thanks to the support of public funding.” Innovation Research Analyst, Banking “There is a general excitement around entrepreneurship. Corporate companies are involved in the process and capital is available to invest in startups.” Managing director, Funds Note : in percentage of respondents, figures not available for 2012 40 Source: AmCham-Bain Barometer, Bain analysis

SOCIOECONOMIC AND LEGAL STABILITY, LABOR COST, AND WORKFORCE AVAILABILITY ARE THE KEY INVESTMENT DECISION CRITERIA Attractiveness for foreign investors How important are the following factors in your company’s investment decisions? TOP 5** 1 2 3 4 5 Previous rankings Note: in % of respondents, (*) N = New: Choice not offered in previous barometers, (**) Ranking = Very Important + Relatively Important 43 Source: AmCham-Bain Barometer, Bain analysis

FRANCE’S MAIN ASSETS REMAIN ITS GEOGRAPHIC LOCATION, AS WELL AS THE WORKFORCE QUALIFICATION, INFRASTRUCTURE, AND QUALITY OF LIFE Attractiveness for foreign investors How does France compare with other European countries regarding the following factors? STRENGTHS WEAKNESSES Note: ranking = Strenght + Equivalent 42 Source : AmCham-Bain Barometer, Bain analysis

FRANCE’S ATTRACTIVENESS TO INVESTORS HAS SIGNIFICANTLY RECOVERED SINCE 2013 Attractiveness for foreign investors According to you, how does your parent company view France in comparison with other destinations in terms of investment? “High-quality and affordable labor is readily available in France. Infrastructure and location are very good for access to European markets. Focus on technology sectors is strong and continues to grow.” Vice President, IT / Digital consulting “France has excellent access to markets across Europe, the Middle East, and Africa.” Vice President, IT / Digital consulting “France looks politically stable compared with uncertainty in the rest of Europe e.g. Brexit and Catalonia crisis.” Consultant, Recruiting “Bureaucracy and regulation are very complex. France also suffers from social unrest and lack of clarity in tax policies.” President, Chemical industry Note : in percentage of respondents, figures not available for 2012 41 Source: AmCham-Bain Barometer, Bain analysis

YEAR ON YEAR, THE POSITION OF FRANCE HAS IMPROVED MAINLY ALONG THE LEGAL CERTAINTY, ECONOMIC CONTEXT AND SOCIAL CLIMATE DIMENSIONS Attractiveness for foreign investors ASSETS TO LEVERAGE WORKFORCE, CE GEOGRAPHIC SITUATION ANFR AND INFRASTRUCTURE OF ON TI POSI IMPROVEMENT PRIORITIES COST, LABOR LEGISLATION, TAX SYSTEM AND ADM. PROCEDURES IMPORTANCE OF CRITERION Criteria in 2016 Criteria in 2017 Note: Position of France = % strengths - % weaknesses, Importance of criterion = % very important - % not important 44 Source : AmCham-Bain Barometer, Bain analysis